Post Office PPF Scheme- Our country has had a long history of post office service. It not only provides postal services but is also known for offering a variety of financial plans. In fact, by opening an account at the post office, you can make investments. The Post Office PPF Scheme is highly popular because it offers numerous benefits to investors. The biggest advantage of this investment strategy is that you do not have to pay tax on the invested cash.

Post Office PPF Scheme 2025

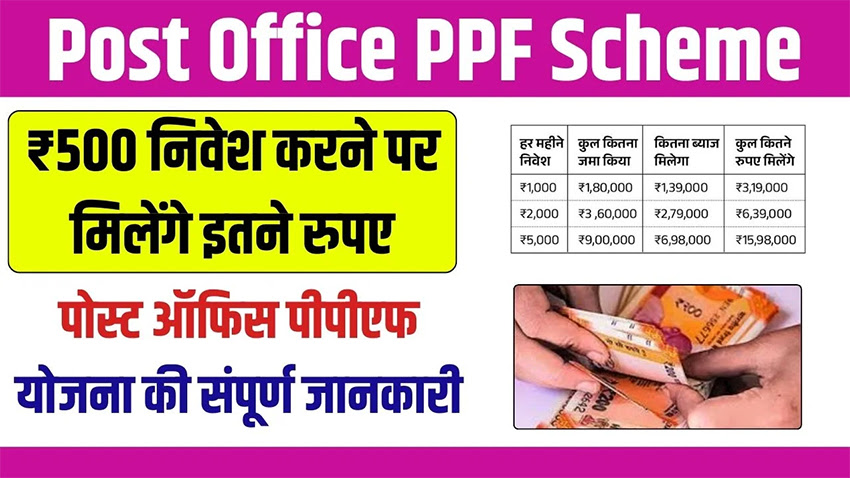

The Post Office PPF programme is one of the best-known investment schemes in our country. To clarify, this strategy needs you to contribute for a period of 15 years. You can open an account with a minimum of ₹500 from your funds. You can save up to ₹1.5 lakh annually with this scheme. Additionally, under the Income Tax Act of 1961, investors’ interest is tax-free. This helps you to save for a long time by investing in this strategy.

Post Office PPF Scheme 2025 Details

| Authority | India Post (Department of Posts) |

| Name of Program | Post Office Public Provident Fund Scheme |

| Investment Amount | ₹500 to ₹1.5 lakh/year |

| Mode | Online/Offline |

| Benefit | Tax-free returns, Secure savings |

| Beneficiaries | Indian residents only |

| Category | Schemes |

| Official Website | https://www.indiapost.gov.in/ |

Read More:-

Key Features of the Post Office PPF Scheme

- Minimum Investment: Start with a minimum of ₹500.

- Maximum Annual Investment: The maximum limit for annual investment is ₹1.5 lakh.

- Maturity Period: The scheme matures in 15 years, and you can extend it for an additional 5 years without further investment.

- Loan Facility: You can take a loan between the 3rd and 5th year, up to 25% of the deposited sum.

- Tax Benefits: The scheme is completely tax-free, including the interest earned.

- Nominee Addition: You can add a nominee even after opening the account.

- Government Guarantee: This scheme is backed by the central government, ensuring full security for your investments.

Benefits of the Post Office PPF Scheme

- You can open an additional account for a minor member if you already have a PPF account.

- The scheme guarantees the return of your invested amount, as it’s supported by the central government.

- Only individual accounts can be opened (no joint accounts).

- You cannot close the account before the 15-year maturity period.

- It offers secure long-term savings with the option of loans.

Read This:-

Eligibility

- Only permanent residents of India can open a PPF account.

- An individual can have only one PPF account.

- NRI sare not eligible to open a PPF account.

- For minor accounts, parents or guardians manage the account, but it will be closed and the invested amount returned if the parents pass away.

Required Documents

- Aadhaar Card

- Identity Proof

- Income Certificate

- PAN Card

- Address Proof

- Photograph

- Mobile Number

- Post Office Bank Account Details

Check Also:-

How to Apply for the Post Office PPF Scheme?

- Visit the nearest post office.

- Gather complete information from the concerned officer.

- Fill out the application form to open the account.

- Attach the required documents.

- Submit the form to the post office officials.

By following these steps, you can easily open your PPF account and start saving for the future.

Final Words

In conclusion, the Post Office PPF Scheme offers a secure and tax-free investment option with a 15-year maturity period, backed by the government. With features like loan availability, nominee addition, and tax exemptions, it serves as a reliable savings tool. It is open to permanent residents of India, and the process to apply is simple. This scheme is ideal for those looking for long-term, safe investment options.

Post Office PPF Scheme FAQ’S

What is Minimum Investment Required for Post Office PPF Scheme?

The minimum investment required is ₹500.

Can I Close My Post Office PPF Account Before 15 Years?

No, the account must be held for 15 years before maturity.

Are NRIs Eligible to Open A Post Office PPF Account?

No, NRIs are not eligible for the Post Office PPF scheme.