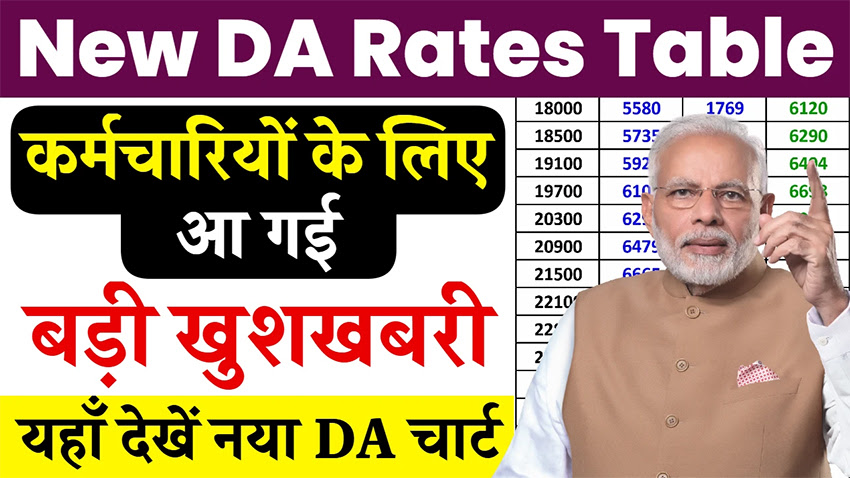

New DA Rates- The Central Government announced that the New DA Rates for employees and pensioners will rise by 3%, from 53% to 56%, beginning in January 2025. This hike, which would guarantee that their pay will increase in line with changing inflation, will directly affect almost 50 lakh workers and pensioners. The DA revision is based on the All India Consumer Price Index (AICPI), which tracks shifts in the cost of necessities.

New DA Rates 2025

The Dearness Allowance, a key part of the pay scale for government employees and pensioners, is changed twice a year, in January and July, and is based on the CPI. To shield employees against price hikes that lower their purchasing power, new DA Rates have been established. The government ensures that these changes take growing inflation into account to assist workers retain a steady quality of living.

New DA Rates 2025 Details

| Authority Name | Ministry of Finance & Department of Expenditure |

| Program | Dearness Allowance (DA) |

| Increase Rate | 3% |

| DA July 2024 | 53% |

| DA January 2025 | 56% |

| DA Revision Frequency | Twice a year (January and July) |

| Beneficiaries | Government employees, pensioners |

| Category | Latest News |

| Official Website | https://doe.gov.in/ |

Read More:-

Calculation & Determination of DA

Dearness Allowance (DA) is an important component of an employee’s salary, aimed at mitigating the impact of inflation on workers’ purchasing power. The calculation of DA is directly linked to the Consumer Price Index for Industrial Workers (CPI-IW), which reflects changes in the cost of living. The base year for DA calculation is set at 2016, with an index value of 100. The formula used to determine DA is as follows:

DA = (Average AICPI – Base Index) × 100 / Base Index

This formula considers the average CPI for the last 12 months to calculate the necessary adjustment in DA, ensuring that employees and pensioners receive an allowance that is in line with inflation and changes in the cost of living. Since DA is directly tied to inflation, it ensures that employees’ salaries and pensions remain up-to-date with the economic condition, providing financial stability.

Impact of New DA Rates on Employees & Pensioners

A 3% increase in DA provides several financial benefits:

- Higher Take-Home Salary for Employees: With the DA hike, employees experience an increase in their disposable income, helping them manage the rising cost of living. This is particularly beneficial for employees with lower incomes, as it protects their purchasing power against inflation.

- Pensioners Benefit: The DA hike also benefits pensioners by helping them manage their monthly expenses more easily, ensuring that their pensions are more aligned with current inflation rates.

- Financial Stability: The DA increase helps employees and pensioners handle higher expenses related to goods and services, thus providing a sense of financial security.

For both central and state government employees, this DA increase comes as a relief, especially given the ongoing economic pressures caused by inflation.

Read This:-

Benefits & Challenges of The DA Hike

The primary benefits of a DA hike include:

- Higher Disposable Income: Employees and pensioners have more money available for spending, reducing financial stress.

- Reduced Financial Burden: The increase in DA helps offset the impact of inflation, making it easier for workers to maintain their lifestyle and manage household expenses.

However, the challenges associated with the DA hike include:

- Accuracy in Calculation: The need for precise calculations to ensure fairness in DA distribution.

- Transparency in Implementation: Improved transparency is necessary to avoid errors in the adjustment process and ensure that the hike reaches the intended recipients.

DA Revisions & Adjustments

DA rates are typically revised twice a year—in January and July—based on economic indicators and the CPI data. Additionally, for public sector workers, DA is updated every three months, reflecting changes in the economic environment. Employee unions have suggested implementing a point-to-point calculation method to increase the accuracy and fairness of DA adjustments. Such a system would ensure that workers receive the exact benefits they deserve, making the salary calculation process more transparent and equitable.

Check Here:-

Advanced Canada Workers Benefit

$2.4 Billion In IRS Stimulus Checks

Final Words

The Dearness Allowance (DA) is a crucial mechanism for adjusting workers’ salaries and pensions to keep pace with inflation. The increase in DA helps to maintain purchasing power, providing employees and pensioners with higher disposable income. While the DA hike brings significant benefits, including financial stability and reduced financial burden, challenges remain in ensuring accurate and transparent calculations. Regular revisions and improvements to the calculation process will continue to enhance fairness in the distribution of DA, ensuring that employees receive the support they are entitled to in the face of rising living costs.

New DA Rates FAQ’S

What is The Formula for Calculating DA?

DA is calculated using the formula: (Average AICPI – Base Index) × 100 / Base Index.

How Often is DA Revised?

DA is revised twice a year, in January and July, and every three months for public sector workers.

How Does A DA Hike Benefit Employees?

A DA hike increases employees’ disposable income, helping them manage rising living costs and inflation.

What Challenges Come with DA Adjustments?

Challenges include ensuring accurate calculations and improving transparency in implementation.